THE SUPPLY CHAIN BLOG

Omnichannel Implications for Distribution Networks

Distribution centers will require more automation, more capital equipment and mostly larger DCs. A large DC a few years ago might have been 500,000 sq. ft. and it is now 1 million or 2 million sq. ft., and they hold potentially an order of magnitude more items or SKUs.

The Impact of Omni-Channel on The Supply Chain

Distribution centers will require more automation, more capital equipment and mostly larger DCs. A large DC a few years ago might have been 500,000 sq. ft. and it is now 1 million or 2 million sq. ft., and they hold potentially an order of magnitude more items or SKUs.

Source: http://www.supplychain247.com/article/the_impact_of_omni-channel_on_the_supply_chain/jda_software

Omni-channel Retailing Creates New Challenges for Supply Chain Managers

Fulfillment options need to change. Retailers are focused on building in-store, web-store and direct-to-consumer options and many are leveraging existing and new infrastructure in creative ways. By using their storefront locations as distribution centers, retailers are better positioned to deliver products quickly to the customer. Standards-based technology such as EPC-enabled RFID will be critical in providing the requisite level of visibility to make this a reality.? The core components need to be meshed together with a high-level, integrated approach that can deliver quality experiences to satisfy today’s consumers and edge out the competition,

Source: http://www.scmr.com/article/omni_channel_retailing_creates_new_challenges_for_supply_chain_managers

Warehouse and Distribution Center Management: Omni-channel distribution—Moving at the speed of “now”

The ability to ship e-commerce orders from brick-and-mortar stores may be the strategy that most are anticipating. Why? Because processing and shipping from the store that’s closest to the person that wants it is the most cost-effective way to support a next-day shipment.

Omnichannel Fulfillment and Location of Distribution Centers

Customers demand an omnichannel shopping experience that allows them to order from anywhere. Therefore, the supply chain has to be able to deliver according to the consumer’s wishes. For example, retailers now include shipping from stores as a distribution option. This increased responsiveness to customers is changing the way a distribution network is set up and managed. Developing an omnichannel supply chain strategy requires rethinking the number and location of distribution centers, as well as their layout and design features.

Customers demand an omnichannel shopping experience that allows them to order from anywhere. Therefore, the supply chain has to be able to deliver according to the consumer’s wishes. For example, retailers now include shipping from stores as a distribution option. This increased responsiveness to customers is changing the way a distribution network is set up and managed. Developing an omnichannel supply chain strategy requires rethinking the number and location of distribution centers, as well as their layout and design features.

Winning the Omnichannel Fulfillment Wars

Many traditional warehouse operations are not set up to efficiently accommodate a large range of orders with varying units and lines per order characteristics typical of multi-channel orders.

Omnichannel distribution centers seamlessly combine both e-commerce and traditional store distribution channels, but it requires significant capital investment in material handling, conveyor sortation and controls, optimized racking systems and lift equipment, inventory management software, and picking/packing technology.

Source: http://apparel.edgl.com/case-studies/Winning-the-Omnichannel-Fulfillment-Wars92316

Warehouse and Distribution Center Management: Omni-channel distribution—Moving at the speed of “now”

An increasing number of retailers will be distributing from their stores. Processing and shipping from the store that’s closest to the person that wants it is the most cost-effective way to support a next-day shipment. But there are some challenges with shipping from stores. For example, contracts with parcel carriers may need to be modified to handle this strategy. Some stores may not even have the space or the labor and you need real-time visibility into available store inventory.

Creating a whole new kind of business out of omni-channel retailing

The line between in-store and online commerce is beginning to blur. Most retailers will turn to outsourcing to a fulfillment center because of the massive investments involved in re-configuring their networks and processes.

Digitization and Decentralization of Distribution

3-D printing and other additive manufacturing technologies, which digitize and reproduce tangible goods will impact how you decide where to locate a DC. Decentralization of production is a trend being fueled by an increase of customization options toward the end of the manufacturing cycle. The size of manufacturing plants will become smaller and move closer to where consumers live. This will have a significant change on distribution of goods because you won’t have as much long haul.

3-D printing and other additive manufacturing technologies, which digitize and reproduce tangible goods will impact how you decide where to locate a DC. Decentralization of production is a trend being fueled by an increase of customization options toward the end of the manufacturing cycle. The size of manufacturing plants will become smaller and move closer to where consumers live. This will have a significant change on distribution of goods because you won’t have as much long haul.

Digitization, decentralization, and omni-channel retail: The future of supply chains

With customized 3-D printing the number of stock-keeping units (SKUs) a company provides will increase. However, it could also reduce the total inventory level for certain products like spare parts, With 3-D printing, instead of keeping them in stock, you have a machine that can make them on demand. The total quantity of inventory will decrease while the number of unique items will dramatically increase.

Impact of Macro Trends on Supply Chains: Digitization of Products

The changes taking place in digitization, specifically additive manufacturing, could have tremendous impacts on the entire distribution network.The digitization of products (necessary for the use of additive manufacturing) will disrupt the dominant design of distribution. While not a huge trend yet, additive manufacturing is starting to be used in direct part manufacturing. In the future the ability to make almost one-of-a-kind customized products on demand could, reduce the demand for mass-produced products. As a result there will be less long distance shipping of finished products and a shift towards transporting the base stock materials used by 3D printers.

Source: http://supplychainmit.com/tag/product-digitization/

Digitization and the Supply Chain

Dan Gilmore from SCDigest brought up the discussion of whether digitization will also eliminate the supply chain for an increasing breadth of products? Nick LaHowchic who wrote a book “Start Pulling Your Chain,” discussed with Dan Gilmore on SCDigest that “Digitization brings into question the fundamental commandments of how we compete in business” Making a sports analogy, “Once in play, the knowledge ball is everywhere.[Supply Chain] team members take turns leading in a networked field, and the playbook is continually referenced for context so we can adjust the plays in real time.”

Source: http://www.scdigest.com/assets/FirstThoughts/08-04-03.php

Growth in E-commerce Distribution Centers

Global online B2C retail sales are increasing. This trend is spurring the need to locate e-commerce DCs closer to customers. Local depots for urban delivery are now needed more than ever. To be successful with e-commerce you need new logistics models which can provide rapid order fulfillment and returns processing.

Global online B2C retail sales are increasing. This trend is spurring the need to locate e-commerce DCs closer to customers. Local depots for urban delivery are now needed more than ever. To be successful with e-commerce you need new logistics models which can provide rapid order fulfillment and returns processing.

Four Reasons 2014 Will Be The “Year of The Global Distribution Center”

Retail logistics has evolved to the point where companies now need to consider mega e-fulfillment centers, parcel hubs and delivery centers, local ‘urban logistics’ depots for rapid order fulfillment, and returns processing centers. They also must think about factors such as: internet penetration, fixed and mobile broadband costs, smart phone usage, demographics, the regulatory climate, the logistics and transport infrastructure, and industrial real estate options.

E-Commerce Fulfillment Centers and How They Do Site Selection

Strategic site selection drivers include workforce, service levels, transportation, cost, real estate, operating environment and more. In the US DCs are more likely to locate in states that do NOT tax internet sales, states with high levels of labor, full and part-time, states with right to work laws, states that house both air and ground UPS/FedEx hubs, states where “zone-skipping” is available to major population centers, states that offer real property or other tax incentives, and states with a robust FTZ program.

How is E-commerce Changing Distribution Center Site Selection?

One solution gaining traction among retail supply chain executives is locating fulfillment facilities closer to their customer base in order to meet service commitment goals such as aggressive delivery schedules. Based on JLL’s Big Box Outlook report,demand for “big box” space (warehouse and DCs that exceed 250,000 square feet) is also growing in secondary major distribution and population hubs such as Indianapolis, Memphis, Phoenix, and Houston as traditional tier-one markets such as Chicago, Atlanta, and New Jersey have become more congested and their supply scarce.

Distribution Center Locations Moving Towards Urban Areas

When it comes to picking the locations of your DCs, it is important to observe the trends in e-commerce and the need to deliver to customers in metro markets.

When it comes to picking the locations of your DCs, it is important to observe the trends in e-commerce and the need to deliver to customers in metro markets.

Pace of Fulfillment Center Construction Continues On, but Now Focus is On Major Metro Markets, not Low Cost, Less Developed Areas

SCDigest discussed observations of Amazon’s network strategy and how it is evolving. They show a diagram from MWPVL which shows that the existing network (blue dots) has been largely in more rural areas, or at least not highly urban – regions where land and labor costs were lower. However, now the facilities under construction are generally in urban areas – the New York City area, Chicago, Philadelphia, etc., as shown in the larger red dots.

Amazon is now looking for the a fast level of order turn-around time (i.e., same day) for all major cities within the US. This is a different approach from the past which focused more on cost.

Source: http://www.scdigest.com/assets/newsviews/14-06-04-1.php?cid=8152

Amazon’s Warehouse Expansion Goes Unabated As A Means To Unchallenged Dominance

Amazon is working on providing Increasingly faster deliveries of online orders — including same-day shipments — to shoppers’ homes. This means they need more distribution centers in metro areas.

Consumers now expect on time delivery to be within the two to three day range. This is just the minimum expectation. The trend is moving from shipping out of a specific warehouse choosing a closer warehouse to serve customers, with faster delivery and cheaper transport costs.

Where You Locate Your Distribution Centers Matter More Than You Think

Hakan Andersson discusses the topic—where you locate your distribution centers (DCs) matter more than you think. It is a topic that Hakan believes is about the fundamentals in supply chain management. The reason is that this is where you have the chance to really make things good and to change things from the bottom up.

Hakan Andersson discusses the topic—where you locate your distribution centers (DCs) matter more than you think. It is a topic that Hakan believes is about the fundamentals in supply chain management. The reason is that this is where you have the chance to really make things good and to change things from the bottom up.

Hello, Dustin, thank you very much for having me here today. Today’s topic—where you locate your DCs matter more than you think—is a topic that I think is about the fundamentals in supply chain management. The reason is that this is where you have the chance to really make things good and to change things from the bottom up.

On a personal note, being a supply chain consultant is a very rewarding job. You get to see a lot, you get to learn a lot, it is very hands-on, and is something that you can understand.

When it comes to supply chain or distribution, network optimization, you are providing the structure for making things right from the start instead of just improving what has been laid out before.

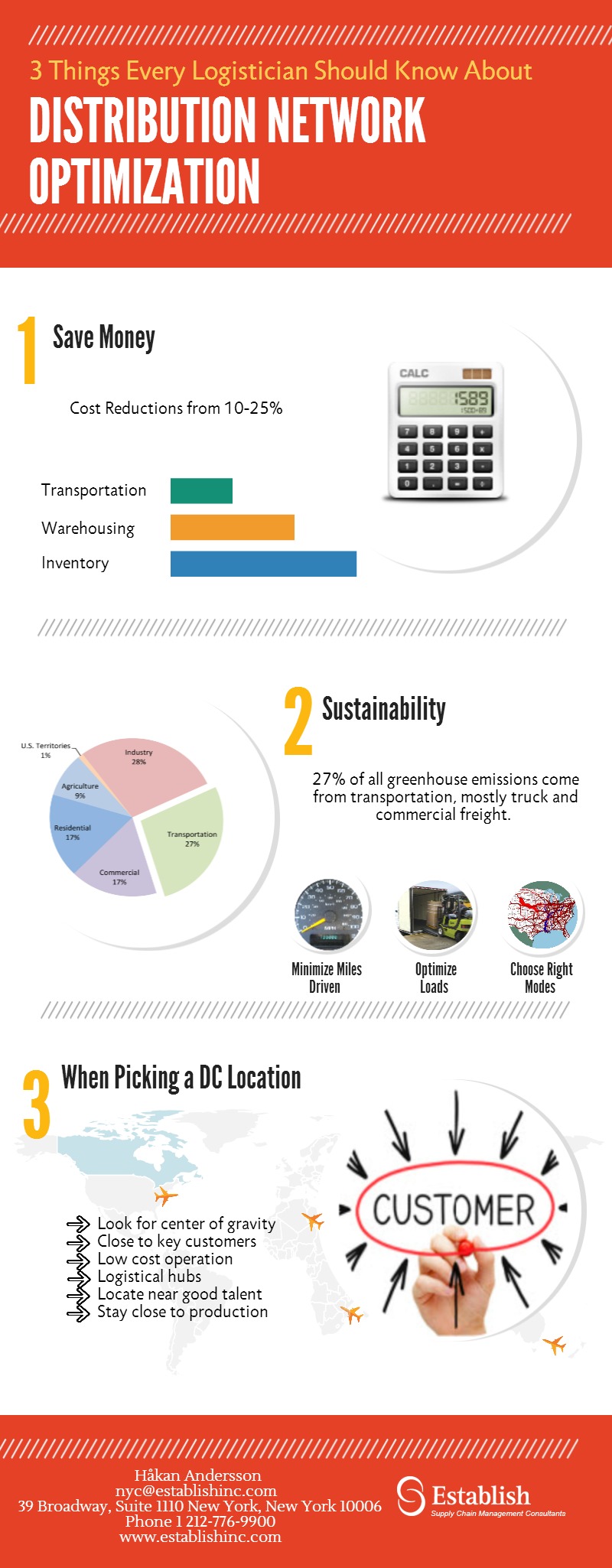

I’ve done this so many times now, and I know that it does save a lot of money. Typically, we would see cost reductions of somewhere between 10 to 25% That is really great. Normally, when you get new transportation routes, you would save an additional 10 to 15 percent in the negotiation phase with the carriers.

You would typically see the cost reductions in transportation, warehousing, and inventory carrying. When it comes to transportation, it’s kind of obvious that what you want to do is to minimize the number of miles that you have to drive and the number of shipments so that you get the most cost-efficient mode and a cost-efficient way of handling it.

When it comes to warehousing, you would consolidate into the most efficient-located and the most efficient location salary-wise, incentive-wise, and real estate cost and everything taken into account. If you do this in the correct way, you would get a better service level with a lower inventory. You would have a win-win situation where, per low cost, you would get a better service.

All of this is great, and those are the reasons why almost all route companies are doing this. But there are other benefits that, to me personally, are more valuable. They very rarely show up in business cases, and very rarely are they a part of the recent way of doing this, and I think that’s a shame. I would get back to that.

The second thing is that when you are doing the network optimization, you have to fight a lot of rational and irrational obstruction and behavior. If we start with the positive side of this, we did establish that you would save a lot of money and reduce cost and you would reduce cost that would directly impact the bottom line, because most of the logistics cost that we’re affecting here are money right out of the company. It’s external invoices that we’re paying or paying less of in the future setup.

When I look at the other benefits—environment, the greenhouse emissions, that’s a huge thing, and we all try to do what we can to—ride fuel-efficient cars, hybrids, we would do recycling our stuff—but we know that according to EPA, 27% of all the greenhouse emissions in the U.S.A., they’re coming from transportation.

Most of transportation is truck, commercial freight, and that is what we’re dealing with as supply chain logistics experts.

If we can set up a structure that minimizes the miles you have to drive the trucks and when the trucks are driving those miles, you can make sure that they are full so they’re not wasting any space and you can make sure that you have the right modes—you’re not flying something that could go on a truck or you’re not trucking anything that can go in water—you have reductions in greenhouse emissions that are far, far greater than what you can do on a personal level.

This is something that very few pay attention to, but this is an area where the logisticians are the heroes.

We know that if we set up a good and well-balanced distribution structure, we know that the accessibility of the stuff that the customer wants, that goes up, which means that if somebody orders something, we can deliver it, and that has a huge impact on whether the customer will return to you.

The way you set it up could also trigger a quicker response and a shorter delivery time.

The struggle that you would have is sometimes caused by very rational reasons, like if you’re afraid of losing your job because this is a more efficient structure; that is a very rational thing to be skeptical of and you will resist change. Or if you would have to move because there is another location that’s more attractive from a logistics standpoint; it’s not an easy thing to uproot your kids and family. Then you have the risk of being outsourced. These are things that we need to be very aware of and to take into account and respect.

The most frustrating is when you see obstructions for other reasons, like there are personal benefits from very long relationships with carriers or other suppliers or there are established truths—“things have always been handled this way” and “we’ve always been in this location; we can’t change,” or when it’s just down to personal comfort that you’ve been dealing with a company for a hundred years and it’s just easy.

I see a lot of this; that’s the darkside of the logistics industry. The way to overcome this is that we try to get people on board that are affected as soon as possible. We also see that younger persons, in general, have a more holistic view on things, and they can see the environmental, the service aspects, and can embrace change in a way that we elders don’t have. And when we have functions outside the supply chain, it also helps a lot.

When it comes to picking the locations, there are so many different aspects to it and there are so many different ways of looking at it, which makes it the more interesting if you’re into logistics and supply chain.

The obvious and most scientific ways to look for is center gravity, which means which location would minimize the number of miles that you have to travel. Typically, if you do that in a consumer industry, you would land somewhere west of Pennsylvania, east of Ohio, that area.

When you have two points, you would typically get one in the northeastern U.S. and one DC in California, Texas, somewhere there. And then you add, if you’re going to have three DCs, somewhere in the Midwest, like Chicago. Then comes somewhere southeast—Georgia. And last, northwest, up in Oregon. We call them the Usual Suspect Five.

There are other strategies that you could embrace here, and center gravity often is just a starting point. You could choose to be close to key customers. The most obvious thing here is if you’re in the auto industry, a supplier to the car makers, you want to be close to where they have their plants.

Dell has taken that to its extreme that you have to have a DC practically on their premises. If you look at Amazon, they are now attacking the cities and having shorter delivery times to the cities, same-day deliveries; and then you need to have the locations close to the cities.

The third approach here is to go for a low-cost operation, where you pick more rural, high-unemployment areas. You would have lower compensation levels, you would have lower cost for real estate, there would be local county/state incentives to establish your operations there; it could be tax reasons.

The fourth and, I would say, very important strategy would be to establish yourself where you have logistical hubs, and this could either be where the carriers would have—you can see at Memphis Tennessee, Louisville, Kentucky; you would see other places where you have a lot of 3PLs.

The reason why we do this is that you would want to be close to a lot of options so that you can change if you’re outsourcing your warehouse. A strategy that is not used often enough I would say is a place that is attractive for your employees to win the war for talent and get really hotshots to join your company.

Then I would say the last strategy and probably the most used is that you stay close to where you have a production facility. This is a knee jerk reaction and an intuitively right way of doing it. It very often pays off to instead be close to where you have your end customers, because from your production side, you can very often efficient transportation, the first leg and then position yourselves where you can have a quick response to your clients, to your customers, and where you can get good reaction time.

I do want to say to finish this up that there is so much more to say about the network optimization, distribution supply chain network both inbound and outbound, but don’t forget that it’s more than a better cost: environmental reasons; the benefits from a service point of view are huge. Thank you very much.

Healthcare Supply Chain Trends

What are the top supply chain issues for the healthcare supply chain in 2013 and 2014? In 2013 UPS published a revealing survey focusing on technology. Other sources discuss a heightened focus on cost cutting and logistics efficiency, while undergoing a re-invention and new strategy development.

What are the top supply chain issues for the healthcare supply chain in 2013 and 2014? In 2013 UPS published a revealing survey focusing on technology. Other sources discuss a heightened focus on cost cutting and logistics efficiency, while undergoing a re-invention and new strategy development.

UPS Survey Reveals 6 Supply Chain Concerns for Healthcare (and other) Executives

New UPS survey highlights supply chain concerns for healthcare executives looking to drive business change & meet business goals – Global Pains Lead to Transformative Strategies. Over the next five years, 84 percent of global healthcare executives will invest in new technologies, according to a recent UPS survey.

Source: http://www.supplychain247.com/article/ups_survey_reveals_6_supply_chain_concerns_for_executives

Supply chain efficiency trends

Hospitals continue to seek strategies to squeeze more efficiency out of their supply chains. For years, hospitals have been trying to discover new strategies for getting greater efficiencies out of their supply chains. The current trends include: Cost education, Improved collaboration, self-distribution and aggregating data.

Source:http://www.healthcarefinancenews.com/news/supply-chain-efficiency-trends

Healthcare Supply Chain Costs: A Tough Pill to Swallow

Organizations all along the healthcare supply chain are taking a dose of smarter procurement and logistics practices to cure high costs and treat ailments in other areas of the business. One big issue emerges from the fact that makers of branded pharmaceuticals will soon see patents expire on many of their most successful products. Facing losses as competitors rush in with generic equivalents, pharma companies are looking for alternative ways to boost their earnings, says John Menna, director of strategy for healthcare at UPS.

Source: http://www.inboundlogistics.com/cms/article/healthcare-supply-chain-costs-a-tough-pill-to-swallow/

Pharmaceutical Supply Chain Security

Supply chain security in the pharma industry is a hot issue right now because the industry has seen tremendous global growth and change. More drugs are moving around the world than ever before. Also, more pharma companies are manufacturing overseas.

Supply chain security in the pharma industry is a hot issue right now because the industry has seen tremendous global growth and change. More drugs are moving around the world than ever before. Also, more pharma companies are manufacturing overseas.

Securing the Supply Chain

In 2012, PhRMA supported the adoption of The Pharmaceutical Traceability Enhancement Code (RxTec). Introduced by the Pharmaceutical Distribution Security Alliance (PDSA), RxTec struck a critical balance between the security needs of the pharmaceutical supply chain and the financial and technological hurdles of adopting security measures.

Source: http://www.phrma.org/safety/supply-chain-security

Pharma Logistics: Can RFID Heal Supply Chain Security?

Can a dose of RFID track-and-trace technology, prescribed by Dr. Wal-Mart, keep the pharma supply chain safe? As more drugs are being transported across borders, security becomes a greater challenge. The potential for tampering increases.

Source: http://www.inboundlogistics.com/cms/article/pharma-logistics-can-rfid-heal-supply-chain-security/

What the Pharmaceutical Industry Can Teach Us about Supply Chain Security Best Practices

According to the UPS 2012 “Pain in the Chain Survey,” 83% of healthcare companies surveyed rank tapping into new global markets as a top strategy for the next three to five years.Today, up to 40% of the drugs Americans take are manufactured outside the U.S., as well as up to 80% of the active pharmaceutical ingredients in those drugs. To successfully protect against these risks, proactive supply chain security must deliver actionable intelligence to mitigate those risks.