THE SUPPLY CHAIN BLOG

Healthcare Supply Chain Trends

What are the top supply chain issues for the healthcare supply chain in 2013 and 2014? In 2013 UPS published a revealing survey focusing on technology. Other sources discuss a heightened focus on cost cutting and logistics efficiency, while undergoing a re-invention and new strategy development.

What are the top supply chain issues for the healthcare supply chain in 2013 and 2014? In 2013 UPS published a revealing survey focusing on technology. Other sources discuss a heightened focus on cost cutting and logistics efficiency, while undergoing a re-invention and new strategy development.

UPS Survey Reveals 6 Supply Chain Concerns for Healthcare (and other) Executives

New UPS survey highlights supply chain concerns for healthcare executives looking to drive business change & meet business goals – Global Pains Lead to Transformative Strategies. Over the next five years, 84 percent of global healthcare executives will invest in new technologies, according to a recent UPS survey.

Source: http://www.supplychain247.com/article/ups_survey_reveals_6_supply_chain_concerns_for_executives

Supply chain efficiency trends

Hospitals continue to seek strategies to squeeze more efficiency out of their supply chains. For years, hospitals have been trying to discover new strategies for getting greater efficiencies out of their supply chains. The current trends include: Cost education, Improved collaboration, self-distribution and aggregating data.

Source:http://www.healthcarefinancenews.com/news/supply-chain-efficiency-trends

Healthcare Supply Chain Costs: A Tough Pill to Swallow

Organizations all along the healthcare supply chain are taking a dose of smarter procurement and logistics practices to cure high costs and treat ailments in other areas of the business. One big issue emerges from the fact that makers of branded pharmaceuticals will soon see patents expire on many of their most successful products. Facing losses as competitors rush in with generic equivalents, pharma companies are looking for alternative ways to boost their earnings, says John Menna, director of strategy for healthcare at UPS.

Source: http://www.inboundlogistics.com/cms/article/healthcare-supply-chain-costs-a-tough-pill-to-swallow/

Pharmaceutical Supply Chain Security

Supply chain security in the pharma industry is a hot issue right now because the industry has seen tremendous global growth and change. More drugs are moving around the world than ever before. Also, more pharma companies are manufacturing overseas.

Supply chain security in the pharma industry is a hot issue right now because the industry has seen tremendous global growth and change. More drugs are moving around the world than ever before. Also, more pharma companies are manufacturing overseas.

Securing the Supply Chain

In 2012, PhRMA supported the adoption of The Pharmaceutical Traceability Enhancement Code (RxTec). Introduced by the Pharmaceutical Distribution Security Alliance (PDSA), RxTec struck a critical balance between the security needs of the pharmaceutical supply chain and the financial and technological hurdles of adopting security measures.

Source: http://www.phrma.org/safety/supply-chain-security

Pharma Logistics: Can RFID Heal Supply Chain Security?

Can a dose of RFID track-and-trace technology, prescribed by Dr. Wal-Mart, keep the pharma supply chain safe? As more drugs are being transported across borders, security becomes a greater challenge. The potential for tampering increases.

Source: http://www.inboundlogistics.com/cms/article/pharma-logistics-can-rfid-heal-supply-chain-security/

What the Pharmaceutical Industry Can Teach Us about Supply Chain Security Best Practices

According to the UPS 2012 “Pain in the Chain Survey,” 83% of healthcare companies surveyed rank tapping into new global markets as a top strategy for the next three to five years.Today, up to 40% of the drugs Americans take are manufactured outside the U.S., as well as up to 80% of the active pharmaceutical ingredients in those drugs. To successfully protect against these risks, proactive supply chain security must deliver actionable intelligence to mitigate those risks.

3 Good Insights from Pharma Supply Chain Consultants

Three good takeaways from leading pharmaceutical supply chain consultants include ensuring product quality in the supply chain, California serialization and pedigree legislation and the re-designing pharma supply chains.

Three good takeaways from leading pharmaceutical supply chain consultants include ensuring product quality in the supply chain, California serialization and pedigree legislation and the re-designing pharma supply chains.

Quality Assurance in pharmaceutical supply chains

Luc Huybreghts gave his opinion on how to ensure product integrity throughout the supply chain of pharmaceutical products, and which pitfalls distributors of pharmaceutical products should look out for. A series of strategies must be considered and deployed in today’s logistics landscape in order to ensure product quality.

Source: http://www.pauwelsconsulting.com/blog/quality-assured/

“ePedigree & Serialization: What You Need to Know NOW for the California 2015 Deadline” by Bill Connell and William McLaury

In this article titled ePedigree & Serialization: What You Need to Know NOW for the California 2015 Deadline, Bill McLaury and Bill Connell discuss how it is clear that California serialization and pedigree legislation will force pharmaceutical manufacturers to initiate and implement a plan of action in 2013 in order to meet the January 1, 2015 deadline. While many large-sized pharma companies appear to be well on their way, smaller and mid-sized virtual pharmaceutical manufacturers need to quickly mobilize resources and ramp up implementation. This article discuss how to begin and components of the roll out.

Source: http://www.pharmamanufacturing.com/articles/2013/022/?page=full

Rethinking the Pharma Supply Chain: New Models for a New Era

The Boston Consulting Group identified four supply-chain models that can lead to optimal performance. This segmented approach to supply chain design is becoming the most effective way for pharma companies to address the challenges and trade-offs they face today.

Pharmaceutical Supply Chain Challenges and a Move Towards External Supply Networks

Considering the significant challenges faced by pharma supply chains, the future will no longer be about internal R&D, but instead about directing significant resources and efforts to collaborate with external supply networks and partners.

Considering the significant challenges faced by pharma supply chains, the future will no longer be about internal R&D, but instead about directing significant resources and efforts to collaborate with external supply networks and partners.

Pharma Supply Chain Execs Focus on External Supply Networks

Constructing Innovation Supply Chains for the Pharmaceutical Industry

Pharma companies are reducing expenditures in R&D. Though many acknowledge that the majority of R&D cuts have been completed, this trend still exemplifies the major shakeup that has caused the industry to reevaluate its focus on innovation and examine the productivity of R&D. A recent study conducted by consulting firm Oliver Wyman concluded that “the value generated by $1 invested in pharma R&D has fallen by more than 70%.

Ensuring pharmaceutical supply chain effectiveness

The pharmaceutical and biotech industry is under severe pressure. Research & Development (R&D) costs are spiralling, development timelines are growing, payer pushback is increasing and consumers are becoming increasingly knowledgeable about care options. The industry is responding driving time out of development, becoming smarter about stopping projects early in the development cycle, and increasing efficiency through rationalisation or outsourcing of non-core activities.

Source: http://www.pwc.com/gx/en/pharma-life-sciences/supply-chain-effectiveness/index.jhtml

New Supply Chain challenges for Pharmaceutical Industry

Healthcare reform, patent expiries and increased service requirements will require pharma-ceutical companies to adapt their business models to accommodate market changes. The coming years, reduced costs, greater agility and improved speed to market – whilst ensuring the often complex regulatory legal framework in countries are being met – will form a challenging operating landscape for companies in the industry.

Source: http://www.supplychainmovement.com/new-supply-chain-challenges-for-pharmaceutical-industry/

Pharma Supply Chain Trends 2014

The pharmaceutical supply chain will undergo changes in the year 2014. New US government regulations, pressures to be more lean and an increase in outsourcing relationships will bring new challenges to the supply chain in the health care and pharmaceutical industry.

The pharmaceutical supply chain will undergo changes in the year 2014. New US government regulations, pressures to be more lean and an increase in outsourcing relationships will bring new challenges to the supply chain in the health care and pharmaceutical industry.

PwC’s Health Research Institute Identifies the Top 10 Health Industry Issues for 2014, outsourcing will impact supply chains moving forward.

PwC’s Health Research Institute published content on their website which discusses the pharmaceutical supply chain and how security is changing to start combating counterfeit drugs. A new federal law – the Drug Quality and Security Act – is aimed at eliminating counterfeit medications in the drug supply chain.

Source: http://www.pwc.com/us/en/press-releases/2013/hri-top-issues-report-press-release.jhtml

Key Trends in the Pharmaceutical Supply Chain

Omer Abdullah, Managing Director, The Smart Cube, Inc identifies four trends that will directly influence pharmaceutical supply chains in 2013-2014: 1. Pharmaceutical companies have been increasingly focusing on aligning research and development capabilities to cater to the escalating demand for drugs globally. 2. With the rapidly volatile economic environment globally, pharmaceutical companies have increasingly started focusing on amplifying their go-to market capabilities as well. 3. Pharmaceutical players have downsized their sales forces and started adopting digital marketing techniques on account of expiration of patents and time constraints involved in drug approvals. 4. Pharmaceutical companies have been increasingly focusing on integrating and aligning key supply chain parameters, such as capacity, inventory levels, and lead times, with market demand.

Source: http://www.sig.org/newsletter.php?id=6753

2014 Trends In Strategic Outsourcing – Changes In Partner Selection

Kate Hammeke, director of marketing intelligence at Nice Insight discuses the 2014 results from Nice Insight’s annual pharmaceutical and biotechnology outsourcing survey. It showed there will be an increase in outsourcing expenditure. Forty-seven percent of survey respondents stated they will spend between $10M and $50M on outsourced projects in 2014.

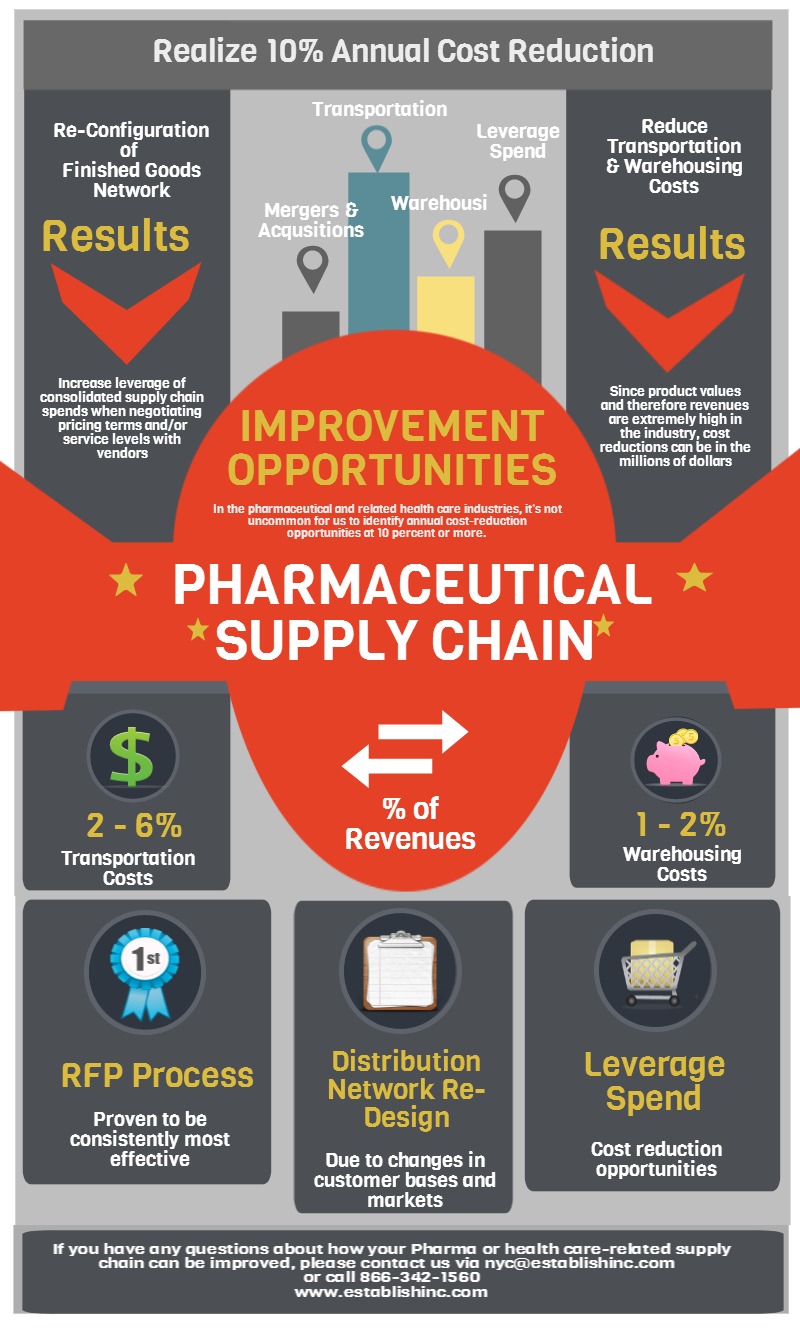

Interview: Conrad Ross Discusses Pharma Supply Chain Improvement Opportunities

In the following video Conrad Ross from Establish discusses the opportunities for improvements in the pharmaceutical and healthcare supply chains. What Conrad has noticed is that in the pharmaceutical and related health care industries, it’s not uncommon for us to identify annual cost-reduction opportunities at 10 percent or more.

In the following video Conrad Ross from Establish discusses the opportunities for improvements in the pharmaceutical and healthcare supply chains. What Conrad has noticed is that in the pharmaceutical and related health care industries, it’s not uncommon for us to identify annual cost-reduction opportunities at 10 percent or more.

Why the Pharmaceutical Supply Chain Needs to be Improved

Hey, Dustin, this Conrad Ross with Establish. I’m calling in response to the question why the pharmaceutical supply chain needs to be improved. Particularly, what are the improvement opportunities in the pharma supply chain? I haven’t talked to you in a while, and I do wish you a Happy New Year. What I’ve noticed is that in the pharmaceutical and related health care industries, it’s not uncommon for us to identify annual cost-reduction opportunities at 10 percent or more. These opportunities are typically found in the configuration of a finished-goods network and transportation and warehousing.

Configuration of Finished-Goods Network

Now, to get specific about mergers and acquisitions. Pharmaceuticals can grow organically by acquisition or by some combination of the two. By “acquisition,” I mean by acquiring other companies and also by acquiring products. Those that are grown by acquisition sometimes, for a variety of reasons, do not always fully integrate the acquisitioned companies’ supply chain purchasing functions into their own. If they were to do so, it would enable them to increase the leverage of their consolidated supply chain spends when negotiating pricing terms and/or service levels with vendors; “vendors” meaning carriers, 3PLs and 4PLs, suppliers, and so forth.

Companies that have grown rapidly by acquisition typically contain significant opportunities to increase their spend leverage and, consequently, reduce their supply chain costs. Leveraging of spends and vendor negotiations, however, is not limited to companies that have grown by acquisition. Companies that have grown organically can also obtain similar cost-reduction opportunities, as can companies that are downsizing. There are many ways to increase the spend levels and, as a result, include vendor negotiations. For example, companies seldom separate the transportation cost contained in the landed cost in their raw materials. Therefore, they miss the opportunity to leverage this spend with the finished-goods spend when negotiating carrier-agreement rates.

In addition, we sometimes find that there are missed opportunities for incorporating transportation costs associated with the transfer of WIP inventories of finished goods into the combined transportation spend. Companies need to look carefully at their entire transportation spend from end to end so that they can capture their best opportunities for leveraging their spend. Beyond levering spend, changes in manufacturing locations, product mixes, customer bases, and related service requirements in transportation warehousing costs always occurring. The finished-goods logistics networks continually need to be evaluated to be certain that they remain efficient and relevant. The configuration of most networks require at least some modifications every 5 years.

Transportation Costs

Transportation costs in a pharma company typically average 2 to 6 percent of revenues, depending on the modes and classes of service used. Since product values and therefore revenues are extremely high in the industry, cost reductions can be in the millions of dollars and sometimes even in the tens of millions of dollars. I think this identifies, Dustin, the potentials for improvement to savings.

Warehousing Costs

Warehousing costs typically average 1 to 2 percent of revenues. While it’s difficult to change third-party warehousing providers, it’s important to know that their costs are in line with the industry. If a new agreement is being negotiated, it’s equally important to know that their proposed costs will also be in line with the industry. Benchmarking warehousing costs and practices is an effective way to make this determination. Another way is to obtain cost through a formal request for proposal, the RFP process. Either method—benchmarking or the RFP process—can be effective. We’ve found that the RFP process is consistently the most effective for a number of reasons.

Pharmaceutical Supply Chain Cost Reduction

In the pharmaceutical and related health care industries it is entirely possible to achieve annual cost-reduction opportunities of at least 10% Cost reductions are part of a broader effort at improving your efficiencies and competitiveness. The following are some recommended steps that should be taken to improve efficiencies and attempt to cut costs in the pharmaceutical supply chain.

In the pharmaceutical and related health care industries it is entirely possible to achieve annual cost-reduction opportunities of at least 10% Cost reductions are part of a broader effort at improving your efficiencies and competitiveness. The following are some recommended steps that should be taken to improve efficiencies and attempt to cut costs in the pharmaceutical supply chain.

Redefining And Strengthening Pharmaceutical Supply Chain Management

Redram Alaedini in Life Science Leader discusses that there are significant business process inefficiencies in most pharmaceutical companies that exist in every department and group. These inefficiencies have slowed the industry and consequently created an environment filled with opportunities for significant improvement and cost reduction. For example, delays in product development, poor manufacturing processes of new product formulations, regulatory delays due to inefficient submissions, inadequate marketing and sales forecasts, and high recruitment costs all put tremendous cost burdens on the supply chain.

Without a strong, lean, and highly motivated supply chain group, any pharmaceutical company would constantly struggle with slow new product introductions, manufacturing difficulties, and product backorders; high inventory, raw material, and labor costs; and significant regulatory issues. Therefore, supply chain improvement initiatives, in most cases, tie in directly with other internal and external departments and groups, and therefore must be undertaken in cooperation with them.

The Pharmaceutical Supply Chain: Supplier Management, Cost Reduction and Beyond (Part 1)

In addition to some major trends taking place in the pharma supply chain, Jason Busch from Spend Matters discusses an analysis of the future of the pharma supply chain. Jason talks about the reasons procurement must be front and center regardless of which scenario or company path an organization wishes to take and compete on the basis of within the industry.

10 steps to improve efficiencies in the pharmaceutical supply chain

In Health Care Packaging 10 steps are outlined for improving efficiencies:

Cut out the middle man (wholesaler)

Improvements in tracking product.

Improve technology in the manufacturing process.

Shift manufacturing outsourcing to new markets like India and China.

Quality control will be increased.

Analyzing how money is being spent and where it is going is a factor.

Cutting costs in areas where there is wastage and money is not being used efficiently.

Supply chain analytics should be done.

Once supply chain analytics have been conducted the pharmaceutical company can then apply the necessary changes needed to increase efficiency and cut costs in the supply chain.

Examining the purchasing team in the company.