THE SUPPLY CHAIN BLOG

The Warehouse Rack Layout Aisle Width Decision

As warehouse consultants, we are fortunate to visit and improve hundreds of distribution operations. The majority, but not all, of the operations require forklifts of some sort. Upon starting my career, one of the things I expected to see in the operations was more standardization of forklift types and, by extension, aisle width. However, that is not the case.

As warehouse consultants, we are fortunate to visit and improve hundreds of distribution operations. The majority, but not all, of the operations require forklifts of some sort. Upon starting my career, one of the things I expected to see in the operations was more standardization of forklift types and, by extension, aisle width. However, that is not the case. Operations of similar applications and volumes can often have different forklifts and aisle widths. Here, I’ll explore some reasons why this may be:

Facility – Oftentimes, the facility may be the constraint. When creating pallet rack layouts, column lines cannot be in the aisles and are best buried in the flue spaces. As such, sometimes the column grid guides the aisle width decision. Also, the facility could have limited height, encouraging bulk floor storage where possible, which limits the truck types used.

Warehouse Management System (WMS) – Some types of racking, such as double deep, drive-in or pushback, require additional functionality to the WMS. Without the functionality, many types of rack cannot be used optimally, which affects the truck type and aisle spacing.

Item Profile – If an item is heavy or bulky, it may require a certain type of truck (for example, a counterbalance instead of a reach) or an extra-long aisle for maneuverability. The reverse is true if an item is too small and only fits in shelving.

Inventory Profile – If the inventory profile contains many pallets of few SKUs as opposed to many SKUs of few pallets, it affects the optimal racking method, thus affecting aisle width and truck decision.

Order Profile – If items are picked in full pallets as opposed to each or case quantities, the best picking method will then drive the truck and rack selection.

Though two operations may appear similar, there are many factors that go into selecting the right aisle width and forklift type. It is not a one size fits all solution nor an easy decision - it requires analysis of several variables.

Lean Supply Chain & Logistics Management Training and Consulting

A lean supply chain & logistics process has been streamlined to reduce and eliminate waste or non-value added activities to the total supply chain flow and to the products moving within the supply chain. Waste can be measured in time, inventory and unnecessary costs. Value added activities are those that contribute to efficiently placing the final product at the customer.

A lean supply chain & logistics process has been streamlined to reduce and eliminate waste or non-value added activities to the total supply chain flow and to the products moving within the supply chain. Waste can be measured in time, inventory and unnecessary costs. Value added activities are those that contribute to efficiently placing the final product at the customer. The supply chain and the inventory contained in the chain should flow. Any activity that stops the flow should create value. Any activity that touches inventory should create value.

Supply chains gain waste and non-value added activities for many reasons, both internal to the company and external. Regaining the lean supply chain may mean addressing many of the same issues that created the problems of extra and unneeded time, inventory and costs.

The ideal approach is to design the perfect supply chain and fit your company’s operation onto it. Supply chain management is meant to reduce excess inventory in the supply chain. A supply chain should be demand driven. It is built on the pull approach of customers pulling inventory, not with suppliers pushing inventory. Excess inventory reflects the additional time with the supply chain operation. So the perfect supply chain would be lean with removing wasteful time and inventory.

A supply chain, with demand pull, flows back from point-of-sale demand (resulting in deliveries to the store) to the customer distribution center, back through to purchase orders placed on suppliers and onwards, up the supply chain. Anything that delays or impedes this flow must be analyzed as a potential non-value added activity.

Lean supply chain management is for all companies. It is not just for manufacturers who practice lean management. It is also for non-manufacturers, wholesalers, distributors, retailers and others.

Lean Transformation in the Supply Chain & Logistics environment can result in benefits such as:

Reduced inventory

Reduced space

Maximized inventory investment

Minimized stock outs

Reduced schedule changes

Minimized expediting

Increase flexibility and responsiveness

Reduce lead time

Reduce errors and extra processing

Improve utilization of personnel

Reduce transactions

Simplify processes

Deliverables

The re-design of key business processes and the implementation of new processes and systems that will improve overall performance of the business which may include:

Lean Opportunity Assessment – Identify Lean opportunities in the Supply Chain & Logistics function.

Lean workshop(s) – Introduction to Lean and other specific training such as needed such as Setup Reduction, Batch Size Reduction, 5S – Workplace Organization, Kanban/Pull System,, Total Productive Maintenance, etc.

Value Stream Mapping (VSM) – A map of the current state for key value streams is developed that serves as a basis for re-designing the various business processes. A future state map is then developed that serves as a “to be” vision.

Kaizen Events – Process improvement events based upon priorities set in VSM future state map(s).

Lean Project Management – Start to finish Lean project management including facilitation, training and advice.

Why an Oversized Inventory Doesn’t Solve Service Level Issues

We are right now working with a great company, who supplies the retail and construction industry. They are totally devoted to quality and would go to any length to ensure that the product is delivered in perfect condition at the right time. With an annual growth of 30 – 40 % it is not surprising that all processes and support systems aren’t fully developed and rules of thumb are used instead. To make sure that an order always can be delivered on time the rule for inventory is 6 months sales in stock. Looking at statistics we saw that the service level was 95%, which is right on the average level in the US industry. Looking at the reasons behind the counter-intuitive “non-100%” service level provided some lessons.

We are right now working with a great company, who supplies the retail and construction industry. They are totally devoted to quality and would go to any length to ensure that the product is delivered in perfect condition at the right time. With an annual growth of 30 – 40 % it is not surprising that all processes and support systems aren’t fully developed and rules of thumb are used instead. To make sure that an order always can be delivered on time the rule for inventory is 6 months sales in stock. Looking at statistics we saw that the service level was 95%, which is right on the average level in the US industry. Looking at the reasons behind the counter-intuitive “non-100%” service level provided some lessons:

It is hard to say what 6 months inventory means. An average growth of 40% means that some products grow by 100 % and some less. So, with the sales history as a guide you will inevitably go wrong on some products.

The demand isn’t continuous on all items. In this specific case the orders from big developers can be totally disruptive and distort the forecasting with unanticipated spikes in demand. This wouldn’t be different with an inventory management system though. You still need to handle this separately.

The supplier lead time and reliability varies for different items. The agreed lead time can be handled fairly conveniently with a more specific rule of thumb, say by different categories or absolutely in an inventory management system. The lack of reliability is a much harder nut to crack, it takes very disciplined supplier management.

Short term it will take some hands-on inventory management to get closer to the 100 %, longer term it will take an inventory management system. In the mean-time it will take some work to figure out what to do with all the mostly obsolete goods in “the grave yard” the rented warehouse where all obsolete goods go.

Canadian Distribution Strategy for U.S. Organizations

For many American companies, Canada can be an afterthought considering its small size relative to the US. However, given its intricacies, it would be a mistake for American companies to assume that Canada is much the same as the US as the Canadian market and topography is very different from that of the United States. The key to unlocking the best Canadian distribution strategy is to understand these differences.

For many American companies, Canada can be an afterthought considering its small size relative to the US. However, given its intricacies, it would be a mistake for American companies to assume that Canada is much the same as the US as the Canadian market and topography is very different from that of the United States. The key to unlocking the best Canadian distribution strategy is to understand these differences.

Canada’s population is 11 percent of the U.S. population based on 2015 data, despite being nearly 25% larger than the contiguous lower 48 United States (38.85 MM square miles vs. 31.12 MM square miles). The Canadian population is primarily inhabited near the continental U.S. border which is 3,987 miles long, as the population map below shows:

Map created in Tableau. Data source: http://www12.statcan.gc.ca/census-recensement/2011/dp-pd/hlt-fst/pd-pl/Table-Tableau.cfm?T=301&S=3&O=D

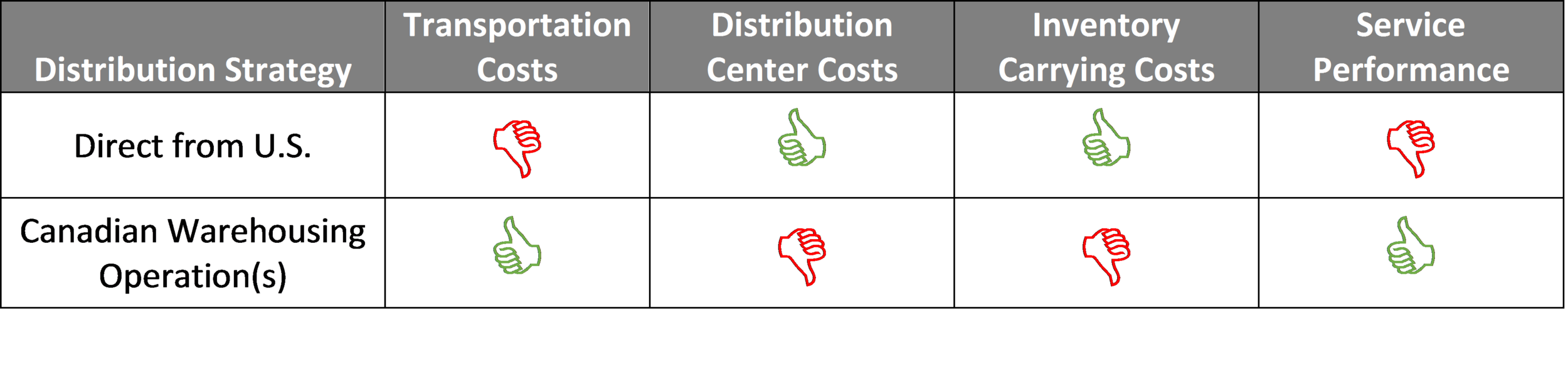

The distribution to Canadian customers can be complex as a result of market, distance, regulations and tax requirements. However, many companies have evaluated their options and selected one of the following distribution strategies either shipping direct from U.S. or establishing warehousing operation(s) in Canada. The selection of which distribution is right depends on a number of factors, such as:

Sales volume

Service requirements

Distribution center costs

Transportation costs

Inventory carrying costs

Type of customer

Etc.

Here are some high-level benefits/disadvantages depending on the strategy:

What Happens When a Company’s Logistics Network Is Optimal?

It is hard to believe, but it does happen once in a while, exactly twice in the 15 years of doing supply chain network strategy work for numerous of companies in different industries, when a company’s logistics network is optimal even though it has not been reviewed holistically for at least 5 years.

It is hard to believe, but it does happen once in a while, exactly twice in the 15 years of doing supply chain network strategy work for numerous of companies in different industries, when a company’s logistics network is optimal even though it has not been reviewed holistically for at least 5 years.

Most companies perform logistics network studies to identify opportunities to reduce costs and improve service and instinctively think relocation. However, at times, this is not the result. There are a number of other opportunities to reduce the logistics costs and improve service performance without relocating a warehouse/distribution center.

The companies who have optimal supply chain/logistics network do benefit from performing a supply chain/logistics network evaluation work. The in-depth process provides an opportunity to identify short- and long-term improvements as well as allows the corporation to realign its goals and objectives across departments on how to best serve its customers today and for the next five years. Typical benefits/ improvements include:

Reevaluation of the current S&OP policies and procedures.

Benchmark (costs, productivity and efficiency) of warehouse(s)/distribution center(s).

Benchmark transportation rates and audit transportation policies and procedures.

Identify transportation mode changes.

Evaluate inventory deployment strategies.

Renegotiate customer requirements.

Redefine shipping policies to customers.

Other

These benefits, at times, are significant impacting the company’s bottom line immediately.

Logistics as an Investment Guide

Can companies’ activities in logistics be a good indicator of investment opportunities? Many investors are looking for companies that that grow very fast while being profitable. Fast track firms selling physical products likely outgrow their existing distribution network and need to expand to satisfy the demand for their products.

Can companies’ activities in logistics be a good indicator of investment opportunities?

Many investors are looking for companies that that grow very fast while being profitable. Fast track firms selling physical products likely outgrow their existing distribution network and need to expand to satisfy the demand for their products. If they can finance such an expansion with their own money, they are likely to also be profitable.

I know from experience that companies expanding their logistics networks or their warehouse capacities often have very good finances and that they in many cases would be good targets for investments. Though it is not a fully scientific way of proving a theory, I have structured the unsolicited inquiries that Establish received last year about new warehouse designs or expansions of distribution networks. Companies that we knew from previous years are exclude to remove that bias.

The resulting list of fast growing profitable companies says a lot about which industries are expanding and the age we live in:

Developers of equipment for virtual reality experiences.

Manufacturers of 3D printers.

Pharmaceutical companies, in general but with an over-representation of vaccine and natural products.

Suppliers of guns and ammunition. These companies are not primarily catering to the military or the hunters…

High quality, very specialized products that have previously been imported from Germany and Scandinavia, but where the production is gradually moving to the US.

Companies in different industries that are using the concept for Delayed Differentiation or Postponement by importing generic pieces from low-cost countries and assembling and customizing the products in the USA. Few SKUs in and many different items out.

Suppliers of equipment for greenhouses. From Oregon and Colorado…

Sports goods; highly specialized Cross-fit and Lacrosse equipment

Suppliers of merchandise around movie franchises

Makers of craft beer and whiskey

Specialized logistics solutions for target industries such as expensive art to frozen food

Companies that handle “The Long Tail” of low frequent products for companies that want to focus on their best sellers but need to provide availability of the other items in their assortment

What do you think?

4 Reasons to Consider Outsourcing Distribution to a 3PL

In today’s on-demand economy, there is a growing number of customers ordering online and who want their products as soon as possible. When you compare this to the past, when consumers did all of their business in-person, it’s quite the contrast. From a warehousing and distribution perspective, it might as well be night and day.

In today’s on-demand economy, there is a growing number of customers ordering online and who want their products as soon as possible. When you compare this to the past, when consumers did all of their business in-person, it’s quite the contrast. From a warehousing and distribution perspective, it might as well be night and day. Gone are the days of full pallets being sent to retailers or regional DCs and here to stay are the days of breaking cases to ship eaches. This monumental change in warehousing is one of the reasons why many companies are outsourcing distribution to Third Party Logistics Providers (3PL). Is outsourcing distribution to a 3PL the right move for you? Below are 4 reasons why it could be.

1. Changing Supply Chain

As mentioned above, the nature of fulfillment has changed and will keep changing. If your company is set in its ways of not shipping to consumer and is looking to expand to e-commerce, a 3PL could be a viable option. Various 3PLs specialize in e-comm and have set-ups ready-made to absorb your business, as well as potential in obtaining favorable parcel rates. It may be a better move to outsource this new mode of fulfillment than to attempt it yourself, especially if there is no in-house experience.

2. Lack of In-House Knowledge

If your company does not have in-house expertise in distribution, a 3PL could be a good move for a couple of reasons: first, the 3PL may be able to reduce costs. Distribution is their business and expertise, so, depending on your levels of efficiency, they can run it more efficiently. Secondly, if you don’t have the in-house knowledge, your day-to-day may be stressful – outsourcing reduces those headaches.

3. Business Changes

A different reason to outsource is a change in business forecast. If your company is rapidly growing, making acquisitions or combining subsidiaries, for example, there are a lot of changes coming to your supply chain. Your warehousing needs can vary in large swings year over year, making an owned or leased building an inefficient option for your distribution operation. The best option would be a 3PL shared warehouse where the 3PL can absorb business changes in their idle space and the infrastructure is already in place to avoid the inefficient and expensive warehouse transitions.

4. Market Expansion/Service Level Improvement

Say you are a company with one DC in the Midwestern United States. Your East Coast customers love your quick lead times, but your Western customers are starting to get a little irked about how they can only get a shipment a week after you process it. How can you make them happier without committing to the long-term? A second DC on the West Coast with a 3PL. This way, you can evaluate the benefits and costs of a second operation without committing to long-term infrastructure investments. A similar reason is to expand into a new market: the best bet for an international company with no US presence is to use a 3PL for much of the same benefit.

These are just some reasons to consider a 3PL – every company has a unique situation and evaluation to make. Need help evaluating if a 3PL is right for you? Establish has completed hundreds of 3PL evaluations and searches and have worked with nearly every 3PL in North America. Give us a call at 212-776-9900 or e-mail us at info@establishinc.com to discuss your supply chain needs.

Consolidating Parts to One Centralized MRO Storeroom

A modified wood products manufacturer was planning construction of an additional plant to fulfill increasing demand. The company had already developed a preliminary layout of the facility in tandem with an architect for budgetary purposes. Establish was tasked with maximizing the storage capacity of the Maintenance, Repairs and Operations (MRO) storeroom space allocated in the preliminary layout.

The Challenge

A modified wood products manufacturer was planning construction of an additional plant to fulfill increasing demand. The company had already developed a preliminary layout of the facility in tandem with an architect for budgetary purposes. Establish was tasked with maximizing the storage capacity of the Maintenance, Repairs and Operations (MRO) storeroom space allocated in the preliminary layout.

Developing a Cost-Efficient MRO Storeroom

All parts at the existing facility were stored at the point of use. While this provided quick turnaround time in the event of a line breakdown, there were several disadvantages to point of use storage:

Securing inventory was nearly impossible. Outside of the primary storeroom, inventory utilization was retrieved by the user and not updated in inventory until control retrieved the use sheets from the location.

Inventory management took an extremely long time to execute. Inventory control had to walk several miles in order to cover the fourteen locations.

The same item was stored in multiple locations. Each location stored extra, thereby increasing the total part inventory.

In order to be close to its point of use, some items were stored in less than ideal locations.

As a result of these flaws, the hypothesis was that the MRO inventory should be centralized in one location, with some of the items only utilized in one location stored at point of use.

Similar to other MRO warehouses, there is wide range in item usage frequency. Some items are accessed several times a day whereas other items aren’t accessed for years. Unlike a typical warehouse, the items that haven’t been used in years are not necessarily obsolete, as these parts may be hard to find, not manufactured any more, or the part may be essential to run the production line. As a result, Establish explored and ultimately recommended customized solutions to match item utilization. Frequently used items were located in the front of the storeroom and are located on shelves for easy picking. Items rarely used were stored on space efficient narrow aisle pallet racks, accessible only by pallet walkers.

Results

The lumber company got a highly efficient layout that consolidated the storage requirements of the fourteen locations in the existing facility into the one space provided in the proposed facility. Only 60% of the anticipated footprint was needed and the inventory control improved.

Key Takeaways

There are tradeoffs between storing items at its point of use and at a centralized location. The conclusion is however that the savings in space, inventory and handling far outweighs the easy access. Most important is the inventory control that ensures that the right items are available.

Item usage frequency is important when determining item storage capacity. The less an item is retrieved, the more inconvenient a location it can be stored in. This inconvenience can be purely positional, such as storing the item in the back of the warehouse, or be due to increased storage density, such as utilizing compression shelving to increase storage capacity in the same footprint.